buy tax liens nj

Ad Find The Best Deals In Your Area Free Course Shows How. At that point real estate investors.

Profiting On Hud Properties Tax Lien Investing Investing Real Estate Investing Free Webinar

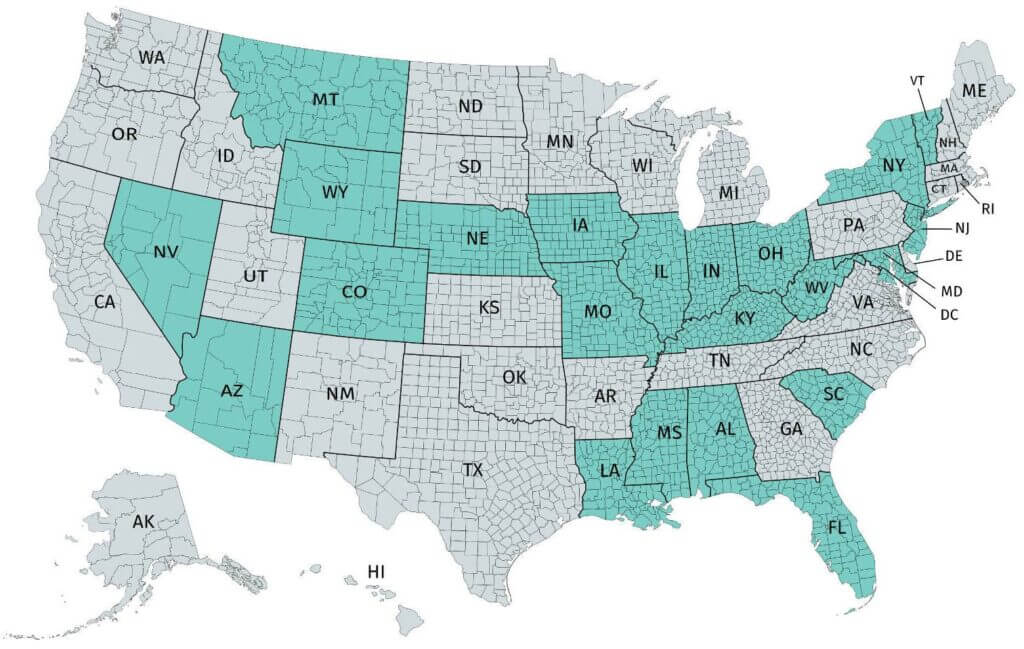

0-18 per annum Subsequent Redemptions.

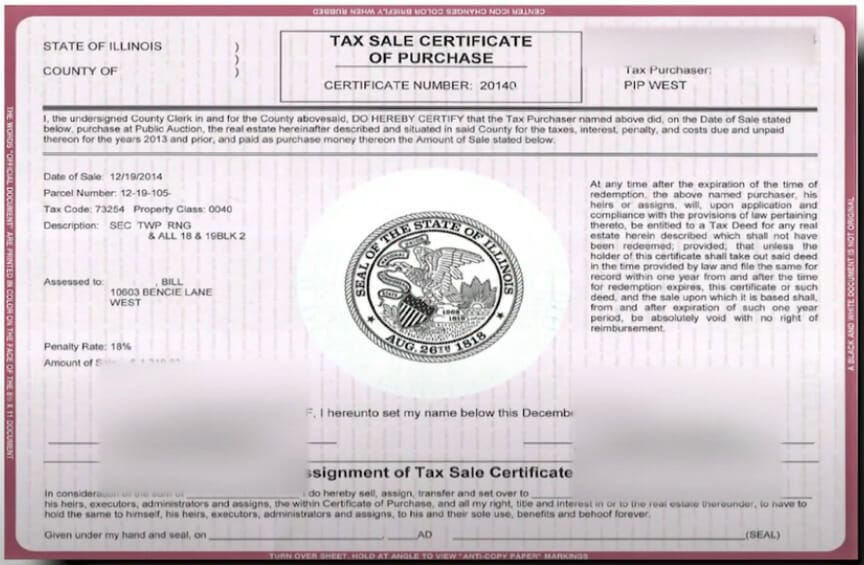

. Tax lien investing is the act of buying the delinquent tax lien on a property and earning profits as the property owner pays interest on the certificate or from the liquidation of the collateral. Here is a summary of information for tax sales in New Jersey. Since the amount that the bidder must pay for the lien is fixed.

All at 18 per. New Jersey is a good state for tax lien certificate sales. Since the amount that the bidder.

Can I buy tax liens in NJ. How do I buy a tax lien property in NJ. Ad Find The Best Deals In Your Area Free Course Shows How.

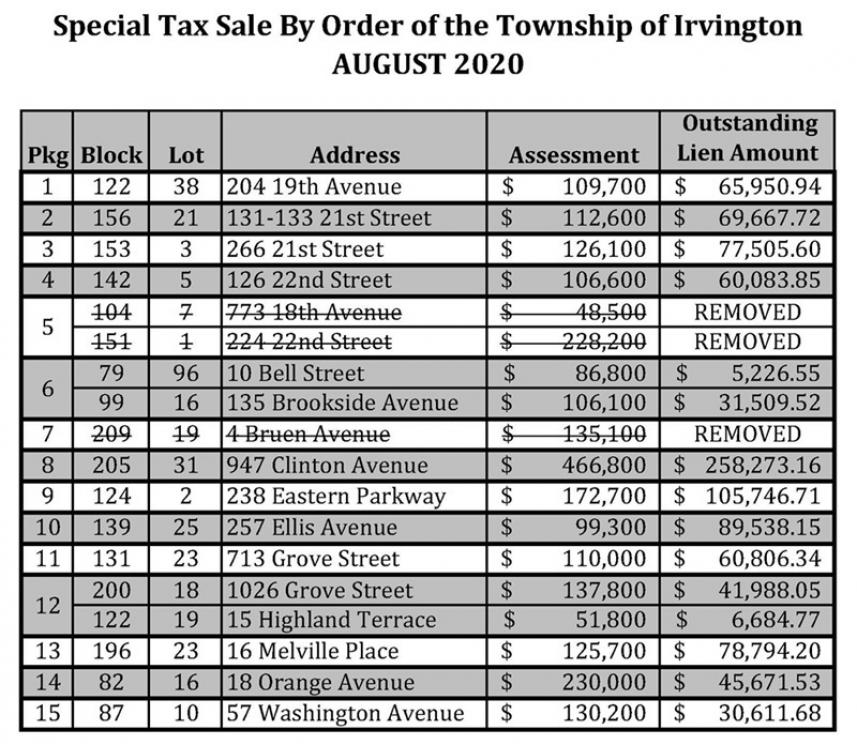

Tax delinquent properties are advertised in a local newspaper prior to the municipal tax sale. Bidding for tax liens under the New Jersey Tax follows a procedure known as bidding down the lien. In New Jersey tax lien certificates are sold at each of the 566 municipal Tax Sales.

Ad Compare New Jersey foreclosed homes by neighborhood schools size more. Sample NJ Tax Lien Certificate Initial Buy. Ad Buy Tax Delinquent Homes and Save Up to 50.

Jersey City NJ currently has 6688 tax liens available as of March 23. CODs are filed to secure tax debt and to protect the interests of all taxpayers. Tax Lien Certificates in New Jersey NJ.

Register for 1 to See All Listings Online. A tax lien is filed against you with the Clerk of the New Jersey Superior Court. Secrets to Buying Tax Lien Investing Delinquent Auction Properties Federal Homes Houses by Brian Mahoney Unabridged 1.

New Jersey requires municipalities to hold tax sales of delinquent property taxes at least once a year. 2622 including taxes and water charges Initial Return. Many people look at the purchase of tax liens as an.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. BIDDING DOWN TAX LIENS Bidding for tax liens under the New Jersey Tax follows a procedure known as bidding down the lien. Comprehensive listings of foreclosures short sales auction homes land bank deals.

If the homeowner cannot pay their property taxes then the county will typically sell a tax lien to cover the expenses of the local government. There are currently 4288 tax lien-related investment opportunities in Jersey City NJ including tax. Tax Lien Tax Deed State Tax Sales in NEW JERSEY NJ.

HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

Make Money With Tax Liens Know The Rules Ted Thomas

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Tax Lien Lady Testimonial Investing Coach Testimonials

Tax Liens The Complete Guide To Investing In New Jersey Tax Liens Paperback Overstock Com Shopping The Best Deals On G Investing Books Bestselling Books

Tax Liens An Overview Checkbook Ira Llc

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

Bid4assets Com Online Real Estate Auctions County Tax Sale Auctions Government Auctions Real Estate Dream Big Online Auctions

Tax Sale Lists Now Home Facebook

How To Remove A Lien On Your Home New Home Buyer Us Real Estate Lets Do It

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Credit Repair Expo 2018 Credit Repair Using Section 609 Credit Repair Attorney Nj How To St Credit Repair Business Credit Repair Services Credit Repair

Understanding Nj Tax Lien Foreclosure Westmarq

What Are Tax Lien Certificates How Do They Work Clean Slate Tax

Which States Are The Best For Buying Tax Liens Alternative Investment Coach

Tax Lien Certificate Financing Firstrust Bank

Tax Lien Investing Pros And Cons Youtube

Hundreds Of Properties For Tax Sale In Monroe County Monroe County County Stroudsburg